inherited annuity tax calculator

Inherited annuities come with a number of tax. People inheriting an annuity owe income tax on the difference between the principal paid into the annuity and the value of the annuity at the annuitants death.

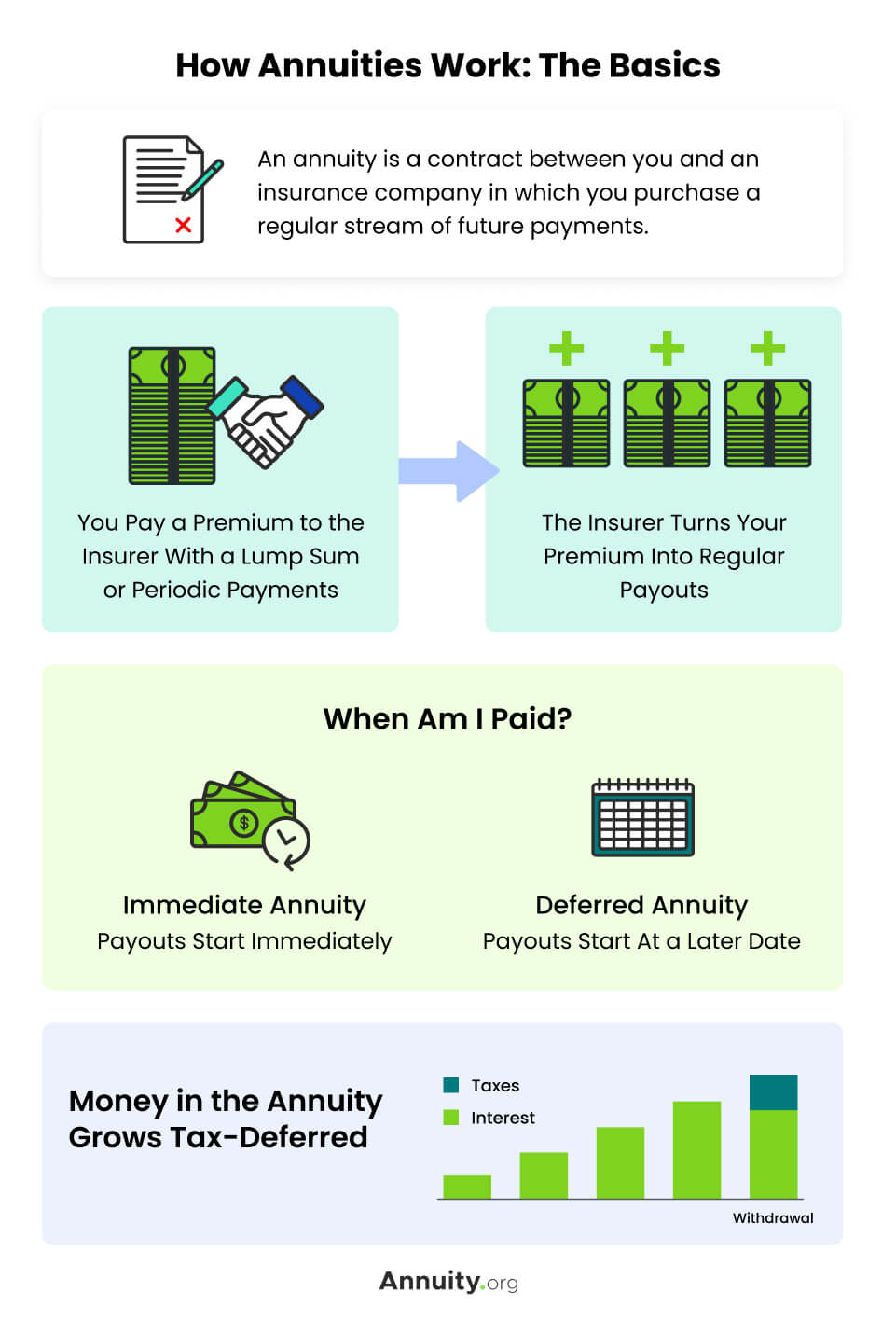

How Annuities Work Examples By Type Considerations

The money from an inherited annuity can be paid out as a single lump sum which becomes taxable in the year it is received.

. In the US a tax-qualified annuity is one used for qualified tax-advantaged. I inherited 3 annuities from my father who died in 2014. For an annuity with a large untaxed gain that could mean that a lot of the money would go to pay state and federal income taxes.

You should receive a Form 1099R Distributions from Pensions Annuities Retirement or Profit Sharing Plans IRAs Insurance Contracts etc from the payer of the lump. Jacksons Retirement Calculator Tool Helps Identify Gaps In Your Projected Monthly Income. TurboTax is asking if the withdrawals were RMDs.

February 26 2020 1008 AM. Inherited annuities come with a number of tax implications especially if the inherited beneficiary is a non-spouse. I inherited 3 annuities from my father who died in 2014.

Qualified annuities are funded with pre-tax dollars while non-qualified annuities are funded with after-tax dollars. If a beneficiary takes the money over time no taxes are owed until the annuity is cashed in. IRS Publication 575 says that in general those inheriting annuities pay taxes the same way that the original annuity owner would.

Some portion of the annuity is generally taxable to you. Ad Our Resources Can Help You Decide Between Taxable Vs. Related Annuity Calculator Retirement Calculator.

In turn taxation of annuity distributions. Tax obligations may possibly be deferred by rolling the lump-sum distribution over into an individual retirement account. Tax rules tax implications tax liability and if you need to pay taxes on the inherited annuity will all come into play.

The exact amount of the payment that is taxable will vary. Inherited annuity tax calculator Saturday March 26 2022 Edit. If you have inherited a retirement account generally you must withdraw required minimum distributions RMDs from.

Surviving spouses can change the original contract. Is inherited annuity taxable. Taxes on an inherited annuity are usually dictated by your beneficiary status and how you receive payouts.

If youre the spouse of the. Calculate the required minimum distribution from an inherited IRA. Estate taxes may come into play as well.

Ad Help Fund Your Retirement Goals with an Annuity from Fidelity. Tax Rules for Inherited Annuities. The main rule about taxation with an inherited annuity or one that is purchased is that any principal that is funded.

According to the IRS. Different tax consequences exist for spouse versus non-spouse beneficiaries. Once the money is inside of an annuity it grows tax-free or rather tax-deferred so the policyholder does not have to pay taxes on the growing account.

Because your wife chose to cash in the annuity a portion of what she received will be income from the invested funds. Ad Help Fund Your Retirement Goals with an Annuity from Fidelity. This difference affects many aspects of how the two types of.

Inherited Annuity Tax Implications. If you have a 500000 portfolio get this must-read guide from Fisher Investments. Ad Learn some startling facts about this often complex investment product.

This is a problem only for non-spouse. Typically all inheritable qualified annuities usually IRA annuities. For each I assume yes part of the distribution was an RMD.

You should receive a Form 1099-R. Tax Consequences of Inherited Annuities. The earnings are taxable over the life of the payments.

Payments can be spread. If you are the beneficiary and inherit an annuity the same tax rules apply. If the beneficiary is a spouse of the deceased annuitant they can carry on.

Are You Looking Forward To Your Golden Years Proper Planning Could Help Ensure That You Ll Have Enough Funds To College Finance Retirement Financial Education

Annuity Beneficiaries Inheriting An Annuity After Death

Annuity Taxation How Various Annuities Are Taxed

Annuity Exclusion Ratio What It Is And How It Works

Annuity Payout Options Immediate Vs Deferred Annuities

We Have Long Term Care Annuities That Double Or Triple Your Client S Premium For A Tax Free Long Term Care Benefit Annuity Retirement Planning Long Term Care

Fidelity Guaranty Life Safe Income Plus Annuity Review Annuity Income Saving For Retirement

We Have Long Term Care Annuities That Double Or Triple Your Client S Premium For A Tax Free Long Term Care Benefit Annuity Retirement Planning Long Term Care

We Have Long Term Care Annuities That Double Or Triple Your Client S Premium For A Tax Free Long Term Care Benefit Annuity Retirement Planning Long Term Care

Qualified Vs Non Qualified Annuities Taxes Rmd Retireguide

The Best Annuity Calculator 17 Retirement Planning Tools

Taxation Of Annuities Ameriprise Financial

Quick Reference Guides Standard Deviation Financial Planning Release

Annuity Formula Calculation Examples With Excel Template

Annuity Beneficiaries Inherited Annuities Death

Inherited Annuity Tax Guide For Beneficiaries

Annuity Taxation How Various Annuities Are Taxed

Use Inheritance To Pay Off Credit Card Debt Not Mortgage Paying Down Credit Cards Ideas Of Paying Down Cr Paying Off Credit Cards Dollar Annuity Retirement